Unforeseen expenses can disrupt financial stability. Whether it’s a sudden medical bill, car repair, or home emergency, having access to a quick lone can be a lifeline during such challenging times. This article explores the benefits of these loans and how they provide a swift solution to unexpected financial hurdles.

I. The Need for Quick Solutions:

Life is unpredictable, and expenses often come unannounced. From unexpected medical emergencies to urgent home repairs, the need for quick financial solutions is crucial. In such situations, waiting for traditional loan approval processes can be impractical. Quick cash loan app fill this gap, offering a speedy resolution to unforeseen expenses.

II. Swift Application Process:

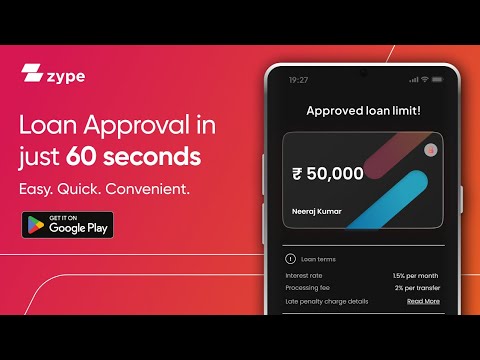

One of the key advantages of quick bank loans is the rapid application process. Traditional loans often involve extensive paperwork and lengthy approval periods. In contrast, these quick loans are designed for efficiency. Online applications streamline the process, allowing applicants to submit necessary information swiftly. The digitized procedures significantly reduce the time it takes for loan approval.

III. Minimal Documentation Requirements:

Quick bank loans typically have minimal documentation requirements, eliminating the hassle associated with gathering extensive paperwork. Basic proof of identity, income, and creditworthiness is often sufficient for approval. This streamlined documentation process not only accelerates approval but also makes these loans more accessible to a broader range of individuals.

IV. Flexible Loan Amounts:

Whether it’s a small, unexpected expense or a more significant financial setback, pay later loan app offer flexible loan amounts. Borrowers can choose the loan amount that precisely matches their immediate needs, avoiding the burden of borrowing more than necessary. This flexibility empowers individuals to address their specific financial challenges without being tied to excessive debt.

V. Speedy Disbursement of Funds:

The essence of loan instant apps lies in their ability to disburse funds rapidly. Once approved, funds are often transferred directly to the borrower’s account within a short timeframe. This swift disbursement ensures that individuals can address their unforeseen expenses promptly, preventing the situation from escalating further.

VI. Convenient Repayment Options:

To alleviate stress during challenging times, quick bank loans come with convenient repayment options. Borrowers can choose repayment terms that align with their financial capabilities. A few banks offer programmed reimbursement alternatives, disentangling the method and lessening the chance of missed installments. If the borrower gets early salary, he or she can even pay the loan amount before the repayment date. This adaptability improves the borrower’s capacity to oversee their accounts successfully.

VII. Competitive Interest Rates:

Though the speed of getting a development is noteworthy, it’s essential to consider the toll taken. Rapid bank progress frequently comes with competitive captivated rates, making them a cost-effective course of action for inciting cash-related needs. Comparing intrigued rates among diverse loan specialists guarantees that borrowers can secure the most excellent conceivable terms, minimizing the general monetary effect of the credit.

VIII. Credit Score Improvement:

Timely repayment of quick bank loans can positively impact the borrower’s credit score. Successfully managing and repaying these loans demonstrates financial responsibility, which is reflected in an improved credit profile.

Conclusion:

In times of unexpected financial strain, quick bank loans serve as a lifeline, providing a swift and efficient solution to unforeseen expenses. As a valuable resource for quick financial support, these loans empower individuals to navigate unforeseen expenses with confidence, ensuring that life’s unexpected twists do not derail their financial well-being.

Leave a Reply